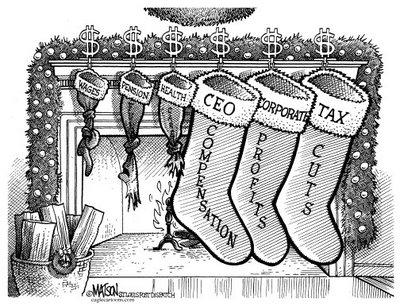

CEO COMPENSATION - Are They Worth The Pay They Are Getting?

What is Executive Compensation? It is how top executives are paid and makes up their total pay package. What does it encompass? They have their base pay, bonuses, stock and stock options. Most of this is based on the performance of the company. Their base pay can be rather hefty, the bonuses can exceed their base salary and the stock and options can exceed the bonuses.

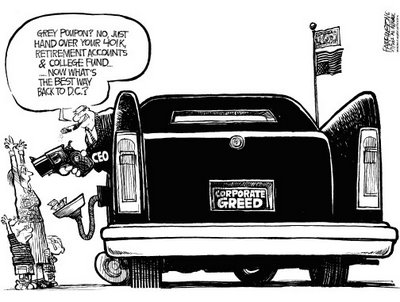

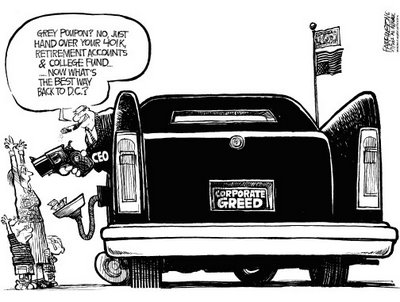

Other parts of the compensation package include retirement benefits, chauffeured limousines, executive jets, interest free loans for the purchase of housing, housing allowances; paid apartments, club memberships, and income tax reimbursements. Steve Jobs, CEO of Apple, not only has access to the company jet, he was also given a $90M Gulf Stream executive jet. Jack Welch, former CEO of General Electric, retained most of his perks when he retired. This included a lavish apartment in New York City including maid, butler and chef services, use of the company jet, and chauffeurs. These have since been given back due to the publicity. One CEO was allowed to create a company that provided consulting services back to the company. This paid that CEO more money for what he was supposed to be doing. When it comes to executive perks, almost anything can be paid by the company.

What kind of compensation are we talking about? In 2002 Larry Ellison of Oracle received a total pay package of $92M; Sandy Weill of CITIGROUP was $151M, Jack Welch - $125M. Even combing all three of these it still didn’t compare to Steve Jobs who received a whopping $381M! Most of these payouts were made up of stock options.

Georges David, UTC’s chairman and CEO, fairs well himself. His total compensation package in 2004 was $98M, #1 among all CEOs. For 2005, Mr. David’s total package was worth $55.8M. He has made nearly $300 million in compensation since he became CEO in 1994, including about $40 million in salary and bonuses and more than $250 million from stock option gains, according to SEC filings. He holds exercisable options valued at $138 million. Directors boosted his salary 42% to $1.7 million in 2005, saying it was his first raise since 1998, and awarded new options valued at $24 million. That raise averages out to 7%. Better than what regular workers get. Institutional Investor magazine survey ranks him tops among his aerospace and defense electronics industry peers because of the company's "exceptional" performance. Most longtime shareholders might not quibble: They've gained about 18% annually under David.

Georges David, UTC’s chairman and CEO, fairs well himself. His total compensation package in 2004 was $98M, #1 among all CEOs. For 2005, Mr. David’s total package was worth $55.8M. He has made nearly $300 million in compensation since he became CEO in 1994, including about $40 million in salary and bonuses and more than $250 million from stock option gains, according to SEC filings. He holds exercisable options valued at $138 million. Directors boosted his salary 42% to $1.7 million in 2005, saying it was his first raise since 1998, and awarded new options valued at $24 million. That raise averages out to 7%. Better than what regular workers get. Institutional Investor magazine survey ranks him tops among his aerospace and defense electronics industry peers because of the company's "exceptional" performance. Most longtime shareholders might not quibble: They've gained about 18% annually under David.

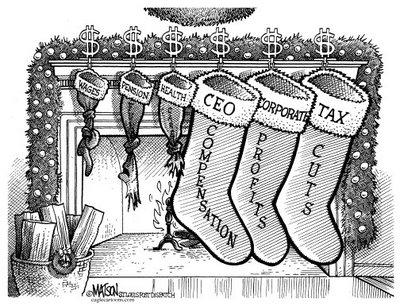

This is an enormous amount of money and we haven’t touched the insurance or pension packages yet. And this just isn’t UTC. It is across all industries. Between 1990 and 2000, the Financial Services compensation packages increased 12,440%; Conglomerates (which UTC is included in) increased 2,496%, Beverages 1,997%, Retailing 793%, and Automotive 283%. If hourly wage earner had their pay increased at the same rate, they would make $470 and hour.

How Insane?

To see how out of control this really is, here are a few CEO’s rewards. More can be found at USA Today.

Capital One Financial CEO Richard Fairbank leads the list after exercising 3.6 million stock options that were set to expire for a gain of almost $250 million.

Cadence Design: The company upped its monthly housing allowance to CEO Michael Fister 240% to $17,000. That's on top of $3 million in compensation and options valued at up to $23 million.

Morgan Stanley: The company gave ex-CEO Philip Purcell $52 million in severance, including $115,000 annually in lifetime administrative support and $250,000 a year to his favorite charities.

KB Home CEO Bruce Karatz's compensation in 2005 included $6.1 million salary and bonus, $31.4 million restricted stock and long-term incentive pay and $118.4 million exercised stock option gains.

3M's James McNerney, who replaced Boeing CEO Harry Stonecipher in June, received $25.3 million in Boeing stock to compensate him for losing potential payouts at 3M. His last six months at 3M proved lucrative, too. He got almost $41 million — $8.4 million in compensation and $32.4 million exercising 3M stock options. There was no golden parachute for Stonecipher, forced out after the revelation of an affair with a subordinate. But Stonecipher made $39.5 million, including $11 million in incentive pay and $26.9 million exercising stock options.[1]

Is it right the CEO of Capital One receives almost $250M from cashing in 3.6M in options? CEO’s getting paid to stay at their house instead of a hotel? Payment for personal financial services? Having medical surgeries performed outside the health care coverage and getting full reimbursement? Receiving money for reimbursement for taxes? This is on top of the 7 plus figure salary and other incentives.

What incentive is there for employee’s to make the company more profitable when the senior executives of the companies are making this kind of money and the rest of the workforce is getting the pay raises in the 2-4% range?

What incentive is there for employee’s to make the company more profitable when the senior executives of the companies are making this kind of money and the rest of the workforce is getting the pay raises in the 2-4% range?

Corporate greed??? Lee Raymond just retired from Exxon-Mobil. His compensation package is $356M!! Just look at what were paying at the gas pumps. Not only is this coming out of the wage earners from his company, this is out of our pockets too! Record profits for the oil companies.

Greater "dividends" would be paid to the stockholders if some these benefits would be pushed down through out the organization. Employees would take more responsibility if they knew they would be benefiting by reaping some of these perks. No person is worth that much money, no matter how well they do!

[1] USA Today CEO Compensation Report - April 9, 2006

Other parts of the compensation package include retirement benefits, chauffeured limousines, executive jets, interest free loans for the purchase of housing, housing allowances; paid apartments, club memberships, and income tax reimbursements. Steve Jobs, CEO of Apple, not only has access to the company jet, he was also given a $90M Gulf Stream executive jet. Jack Welch, former CEO of General Electric, retained most of his perks when he retired. This included a lavish apartment in New York City including maid, butler and chef services, use of the company jet, and chauffeurs. These have since been given back due to the publicity. One CEO was allowed to create a company that provided consulting services back to the company. This paid that CEO more money for what he was supposed to be doing. When it comes to executive perks, almost anything can be paid by the company.

What kind of compensation are we talking about? In 2002 Larry Ellison of Oracle received a total pay package of $92M; Sandy Weill of CITIGROUP was $151M, Jack Welch - $125M. Even combing all three of these it still didn’t compare to Steve Jobs who received a whopping $381M! Most of these payouts were made up of stock options.

Georges David, UTC’s chairman and CEO, fairs well himself. His total compensation package in 2004 was $98M, #1 among all CEOs. For 2005, Mr. David’s total package was worth $55.8M. He has made nearly $300 million in compensation since he became CEO in 1994, including about $40 million in salary and bonuses and more than $250 million from stock option gains, according to SEC filings. He holds exercisable options valued at $138 million. Directors boosted his salary 42% to $1.7 million in 2005, saying it was his first raise since 1998, and awarded new options valued at $24 million. That raise averages out to 7%. Better than what regular workers get. Institutional Investor magazine survey ranks him tops among his aerospace and defense electronics industry peers because of the company's "exceptional" performance. Most longtime shareholders might not quibble: They've gained about 18% annually under David.

Georges David, UTC’s chairman and CEO, fairs well himself. His total compensation package in 2004 was $98M, #1 among all CEOs. For 2005, Mr. David’s total package was worth $55.8M. He has made nearly $300 million in compensation since he became CEO in 1994, including about $40 million in salary and bonuses and more than $250 million from stock option gains, according to SEC filings. He holds exercisable options valued at $138 million. Directors boosted his salary 42% to $1.7 million in 2005, saying it was his first raise since 1998, and awarded new options valued at $24 million. That raise averages out to 7%. Better than what regular workers get. Institutional Investor magazine survey ranks him tops among his aerospace and defense electronics industry peers because of the company's "exceptional" performance. Most longtime shareholders might not quibble: They've gained about 18% annually under David.This is an enormous amount of money and we haven’t touched the insurance or pension packages yet. And this just isn’t UTC. It is across all industries. Between 1990 and 2000, the Financial Services compensation packages increased 12,440%; Conglomerates (which UTC is included in) increased 2,496%, Beverages 1,997%, Retailing 793%, and Automotive 283%. If hourly wage earner had their pay increased at the same rate, they would make $470 and hour.

How Insane?

To see how out of control this really is, here are a few CEO’s rewards. More can be found at USA Today.

Capital One Financial CEO Richard Fairbank leads the list after exercising 3.6 million stock options that were set to expire for a gain of almost $250 million.

Cadence Design: The company upped its monthly housing allowance to CEO Michael Fister 240% to $17,000. That's on top of $3 million in compensation and options valued at up to $23 million.

Morgan Stanley: The company gave ex-CEO Philip Purcell $52 million in severance, including $115,000 annually in lifetime administrative support and $250,000 a year to his favorite charities.

KB Home CEO Bruce Karatz's compensation in 2005 included $6.1 million salary and bonus, $31.4 million restricted stock and long-term incentive pay and $118.4 million exercised stock option gains.

3M's James McNerney, who replaced Boeing CEO Harry Stonecipher in June, received $25.3 million in Boeing stock to compensate him for losing potential payouts at 3M. His last six months at 3M proved lucrative, too. He got almost $41 million — $8.4 million in compensation and $32.4 million exercising 3M stock options. There was no golden parachute for Stonecipher, forced out after the revelation of an affair with a subordinate. But Stonecipher made $39.5 million, including $11 million in incentive pay and $26.9 million exercising stock options.[1]

Is it right the CEO of Capital One receives almost $250M from cashing in 3.6M in options? CEO’s getting paid to stay at their house instead of a hotel? Payment for personal financial services? Having medical surgeries performed outside the health care coverage and getting full reimbursement? Receiving money for reimbursement for taxes? This is on top of the 7 plus figure salary and other incentives.

What incentive is there for employee’s to make the company more profitable when the senior executives of the companies are making this kind of money and the rest of the workforce is getting the pay raises in the 2-4% range?

What incentive is there for employee’s to make the company more profitable when the senior executives of the companies are making this kind of money and the rest of the workforce is getting the pay raises in the 2-4% range?Corporate greed??? Lee Raymond just retired from Exxon-Mobil. His compensation package is $356M!! Just look at what were paying at the gas pumps. Not only is this coming out of the wage earners from his company, this is out of our pockets too! Record profits for the oil companies.

Greater "dividends" would be paid to the stockholders if some these benefits would be pushed down through out the organization. Employees would take more responsibility if they knew they would be benefiting by reaping some of these perks. No person is worth that much money, no matter how well they do!

[1] USA Today CEO Compensation Report - April 9, 2006

0 Comments:

Post a Comment

<< Home